1 Chapter 1: The basics

In this chapter we will:

- Revisit the definition of social welfare and define social welfare policy

- Examine taxation and the US federal budget

- Discuss the values and beliefs underlying social welfare in the US

Social welfare and social welfare policy

As mentioned in the Introduction, social welfare is the well-being of a society. The general response by a society to the well-being of its citizens, generally considered to be social welfare policy, can be in the form of supports, services, programs, legislative actions or judicial action. It can be at the local, state or federal level and can be administered by the government or through various agencies, organizations and individuals.

Social welfare policy affects every member of a society in all aspects of our lives. We tend to consider social welfare to consist of support for people in poverty such as cash assistance and food stamps but it is actually much broader. You are a student at a university. If you are like millions of other college students, you are the recipient of some type of financial assistance – either through a Pell grant or local, state or federal financial aid. You filled out a Free Application for Federal Student Aid (FAFSA) to determine your eligibility for that financial assistance. If you are at a public higher education institution, your rights as a student are protected by the Federal Educational Rights and Protection Act. You may be protected by Title IX of the Education Amendments of 1972. While you were in highschool, you or your family may have qualified for the Supplemental Nutrition Assistance Program or the Federal School Lunch Program. You were provided a free, appropriate, public education, regardless of disability status or income level. If your parents or guardians owned the home you lived in, they benefited from a tax deduction. They were also able to use a tax credit for each child in your household. All of these programs and policies are social welfare. While some of these programs and policies are selective, tied to income level and status such as SNAP, others are universal, meaning that all qualify regardless of income such as FERPA.

Corporations and businesses also benefit from social welfare policy. During the Covid 19 pandemic, more than 6 million small businesses received $416.3 billion just in 2021 (US Small Business Administration, 2021). In addition to financial assistance, corporations and businesses are required to follow legislative requirements and regulations, such as mask mandates or closure orders.

Supplemental Activity

View this video and reflect on how we understand dependence on welfare.

The #GlobalPOV Project: “Who is Dependent on Welfare” With Ananya Roy

In addition to all being recipients of social welfare, we are also providers of social welfare, in that our tax dollars fund welfare programs.

Taxes, social welfare policy and the budget

As we learned in elementary school, one of the foremost reasons we became our own country was because of taxation. One cause of the Revolutionary War was taxation without representation and our intense distaste for taxes has not abated. Because taxes fund social welfare at all levels, it is important that we have a basic understanding of taxation in the US.

At the local, state and federal level, government budgets are primarily funded through taxes. For this chapter, we are going to focus mostly on the federal taxes.

The majority of these taxes are individual contributions based on the individual or married couple’s income. This is considered a progressive tax. In theory, a progressive tax is one in which a person making more money pays a higher percentage of their income in taxes, usually called a tax bracket. Progressive taxes are one way of addressing inequality. People who make more money should contribute more and people making less money should be able to keep more of their money. The reality in the US however is that income taxes are a lot more complicated. While the actual dollar amount that high income earners pay is higher, they often have access to more tax credits and deductions than lower income earners do.

Tax credits and deductions are tools the government uses to reward or provide financial incentive or support for certain behaviors. These are often things we typically consider to be in line with our societal values and cultural norms but can be tied to activities outside the experience of those with lower incomes.

Some examples of tax credits include:

- Child tax credit for children under the age 18

- Child and dependent care tax credit for money spending child or dependent care

- American opportunity tax credit for money spent on tuition, books or school fees.

- Lifetime learning credit also for tuition and fees.

- Student loan interest deduction for repayment of college loans.

- Adoption credit for fees related to adopting children.

- Earned income tax credit for low-income workers.

- Residential energy credits for installation costs of solar energy.

Some examples of tax deductions include:

- Charitable donations.

- Medical expenses.

- Mortgage interest.

- Individual Retirement Accounts contributions.

- Health Savings Account contributions.

High income earners often make their income in forms outside a typical paycheck. As an illustration, let’s look at the compensation of a head football coach at a large state university in the south. His base salary is $245,000 so he will pay income taxes on that amount at the normal rate for his tax bracket minus any credits or deductions he has. But this coach makes $6.25 million more a year in supplemental compensation. That compensation might be in the form of cash bonuses for television ads, a certain number of wins, championships and bowl games appearances, or vehicles, travel and housing. This income will also be taxed but under different rules regarding how much and when. This is often the case for high-level corporate executives who can take their compensation in stock options or deferred compensation and use a different, often lower tax rate.

For a deeper dive, this article from 2019 provides advice for executives to reduce their tax burden.

And for the 1%, those multi-million and billionaires, the formula is completely different, often allowing them to pay little to no income taxes.

For a deep dive look at the issue of the super-rich and income taxes, read this article by Pro Publica.

In addition to income taxes, American workers also have payroll taxes earmarked for specific funds such as Social Security and Medicare at the federal level and education or 911 services at the local levels. Payroll taxes are regressive, meaning that everyone pays the same percentage regardless of income.

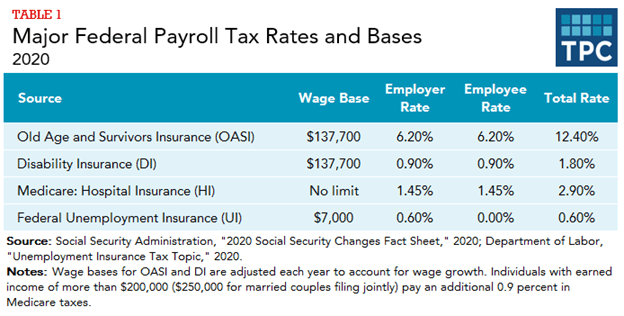

Payroll taxes are paid by both employers and employees – each pays half of the total rate. This was a result of the Social Security Act of 1935 which will be discussed in greater detail later in the book. Old Age and Survivors Insurance (OASI) is commonly called Social Security retirement benefits. Disability Insurance (DI)

is also called Medicare, health coverage for people over the age of 65 and some people with disabilities. It is important to note that there is a “wage base” or limit on the income which is subject to OASI and DI as noted above. All wage earners between $0 and the wage base pay 6.2% in OASI and .9% in DI. Once the employee reaches a year-to-date compensation of the wage base, however, they no longer have to pay any OASI or DI on that amount. The wage base can increase or decrease each year based on the national wage index base. In 2020 as noted above, it was $137,000. In 2022, it was $147,000. The reason that this is considered a regressive tax is that 6.2% of the income of someone making $25,000 is going to have a much bigger impact than 6.2% of the first half of the income of someone making $275,000 a year. Also, payroll taxes are only applied to the base salary. So, as noted above, someone who receives the majority of their income through bonuses or stock options will not pay as much payroll tax.

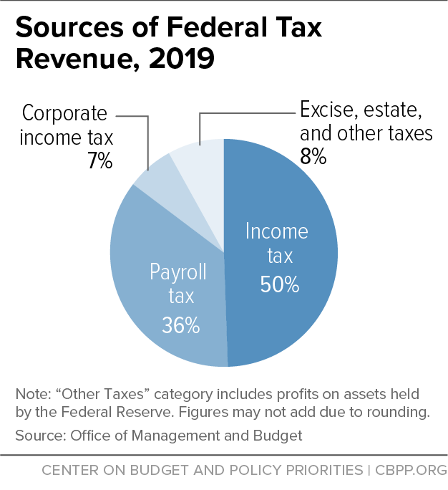

The remaining tax money used by the government to fund social welfare comes from businesses and corporations and taxes paid on specific things such as property, estates and certain goods (excise taxes). As you can see from the chart at the beginning of this section, those taxes account for only about 15% of the federal budget.

Budgets and social welfare policy

As we have stated already, social welfare policy is the collective response of a society, usually through the government, to the needs of the people. This is largely done through policy at the legislative and executive levels, implemented through programs and services provided at the local and state levels. Often the judicial branch is called to determine the constitutionality of those policies and how taxes are collected and spent.

The federal budget process is long and complex. It starts with the president submitting their budget request that outlines their administrative priorities. Congress then develops its own budget resolution, following by the enacting of budget legislation. It is not often that the president and Congress have the same priorities which means that the budget process is long and contentious.

For a deeper dive, you can read a lot more about the whole process from this article by the Center on Budget and Policy Priorities.

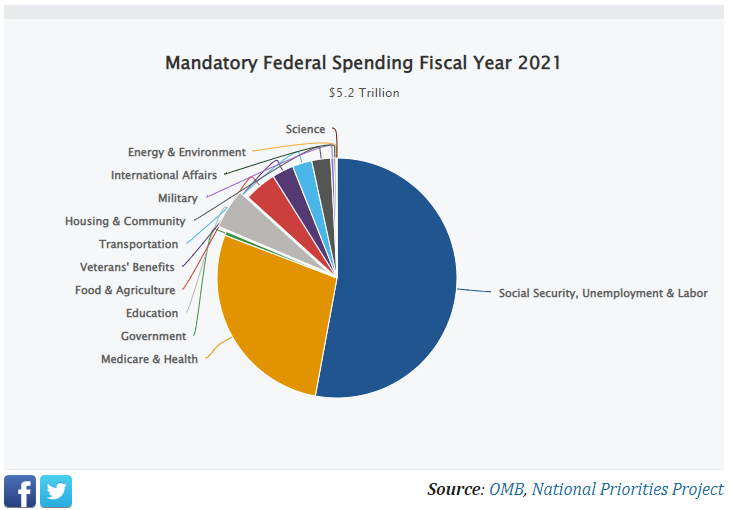

There are three basic types of spending in the federal budget: mandatory and discretionary and interest on the national debt. Mandatory spending covers the programs that are set by law and instead of having a set amount of money, they have rules for who can receive the money. Anyone that meets the criteria receives the service or money. The three biggest programs of this category are Social Security (that Old Age and Survivors Insurance covered earlier), Medicare (Disability Insurance) and Medicaid, medical coverage for children and people with low income. This category also includes Supplemental Nutrition Assistance Program (“food stamps”), federal civilian and military retirement benefits, veterans’ disability benefits and unemployment insurance. As you can see in the chart below, there are also other programs that are automatically included in the budget at set spending levels. Highway construction and maintenance as well as agricultural programs such as the Beginning Farmers and Ranchers Development program are under mandatory spending.

Because mandatory money does not technically run out, it allows more flexibility in responding to unexpected circumstances such as the Covid 19 pandemic. The federal response to the pandemic was largely funded through mandatory spending programs. This meant that anyone that qualified for a program was able to participate without regard to cost. Through the CARES legislation, states were able to provide unemployment benefits to people not usually covered by unemployment insurance. The federal government also was able to provide stimulus checks to taxpayers and advances on the Child Tax Credit to parents through mandatory spending categories.

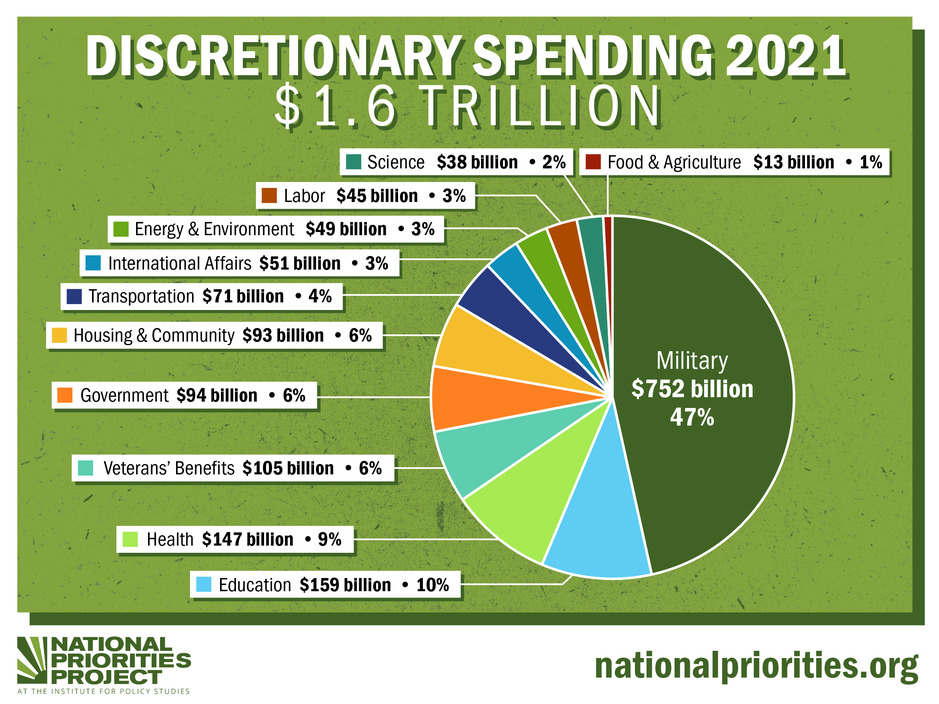

Discretionary spending, however, is set by Congress at a specific funding level. This area of spending is more likely to represent the values of the majority party in Congress, as they are able to control the budget process. As you can see in the chart below, national defense spending is almost half of all discretionary spending. Unlike mandatory spending, money given in these categories can and does run out, often leaving needs unmet.

An example of this is in the housing and community sector. Federal support for housing subsidies for low income families is part of the discretionary spending budget. The federal government provides grants and financial assistance to states and local governments to provide financial assistance for individuals and families who have incomes below the federal poverty rate. This assistance is often in the form of Section 8 housing vouchers, payments to landlords to supplement the rent paid by the resident. Because the funding for all housing and community programs is restricted through the budget process, states and localities often run out of money before serving all eligible residents. The national average wait time for Section 8 housing vouchers is two and a half years (CBPP, 2021).

As social workers, we are keenly aware of discretionary spending at the federal and state levels as this often provides the financial support for services most needed by our populations at risk. As the chart below clearly identifies, military spending is the biggest category by more than three times (National Priorities, 2020).

The historical underpinnings of social welfare in the US

Social welfare at the governmental level in the US did not formally start until the 1930s after the Great Depression. Prior to that, the first immigrant settlers to America continued the tradition of the Elizabethan Poor Laws. These British laws established a basic level of governmental responsibility for the worthy poor living within a distinct community while limiting aid to those outside the community or deemed able to work. Worthy poor were considered people who could not be expected to provided for themselves. Children, the elderly and people with physical disabilities were considered worthy of aid. Men of working age, women who had children outside of wedlock and people with substance abuse disorders were declared unworthy and often were subject to harsh punishment. Early social welfare was provided by charitable organizations, predominantly religious institutions.

Supplemental Activity

The American version of the Poor Laws established local jurisdictions in the original colonies that were responsible for the poor in that locality and enacted taxes for the services provided. While charitable organizations provided most social welfare, each jurisdiction had responsibility for only those worthy poor who could prove residency. This ensured that people could not travel around and seek aid from different places and sources. This form of social welfare was considered to be a last option – only after the individual or family had exhausted all other sources of help and were in crisis. This type of social welfare is considered to be residual. Residual social welfare is provided only when there is no other option available to the individual or family through personal supports or the market economy. Residual welfare is designed to be limited and short-term – encouraging the recipient to become self-sufficient as quickly as possible.

Institutional social welfare, on the other hand, is designed to support the society as a whole. It is enacted to provide services to all, as a natural part of living in a collective. Institutional social welfare is focused on either preventing social problems, such as public health policy, or promoting the general well-being, such as free public education. Institutional social welfare in the US was slower to develop due to a focus on individual solutions rather than governmental action and the desire to focus all governmental action at the lowest possible level – in most cases, the local level.

For a deeper diver on residual and institutional social welfare from an international perspective, read Mishra, 1987.

Why are we this way: American values add racism/white supremacy

In several places in this chapter, we have alluded to values, defined as the worth, desirability, or usefulness placed on something.

Our personal values explain what we believe is right and wrong, good and evil, desirable and undesirable. Beliefs are the opinions or convictions we hold that reflect our values. For example, I value children. I believe that all children, regardless of who their parents are or where they were born, should have the right to all the supports and services they need to be healthy and happy. Our early values and beliefs are influenced by our families of origin, our communities and our faith traditions. As we gain more life experience, our values and beliefs can and often adapt to reflect our changing understanding of the world around us. Our values and beliefs can also change as a result of major changes in society. An example of this on a societal level is acceptance of same sex marriage. According to the Pew Research Center, 60 percent of Americans opposed same sex marriage in 2004 (2019). By 2019, 61 percent of Americans support marriage rights for same sex couples.

Understanding societal values and beliefs is particularly important when we are seeking to understand the historical development of social welfare policy. It is those values and beliefs, some which are strongly entrenched in our understanding of what America is and who is an American, that drive the policy response, or lack of response, to social problems. There are a couple key terms we will explore before looking more closely at commonly held American values.

American Exceptionalism is the belief that the values, practices and principles that define the American way of life are superior to any other country. Borstelmann (2020) described it this way:

“The ultimate logic of American exceptionalism, on most prominent display during the Cold War, held that U.S. history and American institutions had facilitated the full liberation of the human spirit and the fulfillment of the highest human aspirations. This was, it seemed to many of its people, the nation that had finally embodied liberty and happiness for its residents. American democratic culture was thus seen as truly “natural,” in common American thinking, giving citizens self- rule, individual freedom, and a market economy that sold them what they wanted and needed” (pg. 2).

In 1776, with the Declaration of Independence, and then in 1787, in the US Constitution, the forefathers of the country outlined the framework of a democratic (run by the people), capitalist (profit based and privately run market sector) country. These documents also reflect the values and beliefs of the men who wrote them in relation to the world as they understood it at the time. Since then, even though the world and our country have changed greatly, we see the vestiges of those values and beliefs in all of our responses to social problems.

The American way of life and the American Dream are reflective of this idea that democracy and capitalism are the best. We are the “land of opportunity” and anyone that works hard can achieve greatness. Historically and currently, we see these values deeply embedded in our policy. We will now discuss the three main categories of American values and look at how they are reflected in policy.

Racism and white supremacy

Personal values

The first category is personal values as discussed at the beginning of this section. Personal values are shaped by our own experiences and reflect our beliefs. These can vary greatly from person to person, influenced by our backgrounds, families, and often overlap with religious beliefs. Our personal beliefs and values help us to understand the world as we encounter it.

We can see challenges to our personal beliefs when we are exposed to populations or situations that don’t align with what we previously experienced. This can occur when someone’s understanding of a culture or population is only based on anecdotal evidence through other’s stories or the media and then meets someone from that culture or population. In a class not too long ago, a student was sharing their experience of homelessness. Other students in the class were shocked to learn that someone could be a college student with a child and still be homeless. It challenged their beliefs about who could be homeless and what causes it – in this case, interpersonal violence and a lack of a family shelter in their community.

As social workers, our personal values can sometimes be in conflict with our professional values. Social Workers are guided by the Code of Ethics of the National Association of Social Workers (2022). This Code outlines six main values:

- Service.

- Social justice.

- Dignity and worth of the person.

- Importance of human relationships.

- Integrity.

- Competence

According to the Code, Social Workers

“recognize and value the importance of human relationships, and work to strengthen these relationships in order to enhance the well-being of individuals and communities” (NASW, 2022). However, certain faith traditions teach that same sex unions are not acceptable. A professional Social Worker who is a member of that particular faith may be called to work with a family that is headed by a married same sex couple. This could cause a personal ethical conflict for that worker. The expectation is that professional social workers will be able to practice our professional values while working in that capacity.”

Religious values

One of the founding tenets of America is the separation of church and state. This was established in the US Constitution, stemming from the European tradition of a state religion. Many of the original pilgrims left England in search of religious freedom. Although we do not have a state religion and people are largely free to practice, or not practice, any religion they choose, America has been largely developed as a Christian nation. Interpretations of Biblical teachings have impacted policy from the early days of the nation regarding slavery and abolition, women’s suffrage and Prohibition, and continue to impact policy regarding same sex marriage, reproductive freedom and rights for transgendered and non-binary individuals.

Religious involvement in the provision of social welfare services started at the beginning of the country. Early public welfare in the US was provided by charitable organizations in the country and developed on religious ideals of charity and benevolence. All faith traditions call for followers to provide assistance to those in need and this was practiced in the US from the earliest days by religious organizations. The goals of these organizations were to promote moral character and help the less fortunate. This tradition continues today. In 2020, individual Americans gave more than $324 billion to charity, according to the National Philanthropic Trust (2022). Religious organizations such as the Catholic Charities US, Lutheran Services in America and the Jewish Funders Network provide social services and funding, filling in large holes in the safety net for vulnerable populations.

Social values

Social values are informed by personal and religious values but are more reflective of the values that drive us as a country. There are two main themes that drive the response to social problems and the development of social policy:

- Individualism: Hard work and self-sufficiency

- Collectivism: Social responsibility and citizenship

Individualism, or individual responsibility is one of the hallmarks of American Exceptionalism and is reflected in all aspects of our culture. Prigmore & Atherton (1986) wrote that American social values tend to focus on achievement and success; activity and work; efficiency; and practicality and progress. These values are in line with the mindset of early Americans – those people who left Europe in search of a new world. This also reflects the Protestant Work Ethic, an sociological concept that came from the teachings of Martin Luther in the 1500s. He held that godliness was measured through hard work and restraint. America soon became known as the land of opportunity and anyone could “pull themselves up by their bootstraps” and achieve the American Dream. This value is still widely held today and we see this reflected in the desire for as little government involvement in our day to day lives as possible and policy that encourages individuals to solve their own problems through work.

Collectivism, or social responsibility, refers to communal or societal response to ensure the well-being of all. This value is reflected when we come together as communities or a nation to support victims of natural disasters, those under military attacks or collective achievements by groups. Social responsibility is providing supports to those who can never achieve self-sufficiency or resources to citizens regardless of income or social status. The Social Security Act is an example of policy driven by the value of social responsibility. This act ensures that there is public welfare and social insurance for all people, paid from through income and payroll taxes by most people. Another example of collectivism was the Covid 19 Pandemic mask mandates – everyone had to wear masks to ensure that those most at-risk were protected on some level.

We see these two social values in competing beliefs that underlie our social welfare system:

- Undeserving v deserving

- Individual responsibility v social responsibility

- Individual change v social change

- Self-sufficiency v social support

- Entitlement v handout

- Aid to those we know v aid to strangers

- Religious and faith based practice v separation of church and state

- Crisis response v prevention

- Sympathy v empathy

- Trust v suspicious

- Rationality v emotions

We will be able to identify the competing values underpinning the social problems identified in America and then the values that are represented in social welfare policy designed to address those problems. For example, consider the Covid 19 Pandemic again. Individual responsibility v social responsibility and crisis response v prevention were two examples of the competing values we saw expressed in households, cities, states and across the nation. In some states, we saw social responsibility as the primary value. Governors in these states issued broad closures, curfews and mask mandates under the assumption that we all had a responsibility to stay isolated to protect the most vulnerable and our health care and first responder systems. In other states, the responsibility was largely left to individual communities and families to take precautions if they deemed it necessary.

We could also see the difference between a crisis response and prevention when we analyze where resources and policies focused – on dealing with those already impacted or seeking to prevent further harm. Widespread closures and shutdowns were a crisis response. Without taking much time to examine the impact, many governments at all levels ordered shutdowns of public facilities including daycares, schools, and government services. As we are now discovering, these quick actions may have prevented more fatalities but have long-term ramifications for all of us.

Policies such as vaccine mandates, mask mandates and contact tracing focus on prevention – trying to prevent serious illness and reduce the impact of further exposure. It is not always possible to start from a prevention strategy in the face of an emergency.

We will continue to explore these values as we examine the historical response to social problems in the US.

Questions to ponder

In this chapter we have discussed what social welfare is and the values that impact what it looks like. Have you considered the ways in which you and your family have benefited from social welfare policy?

We have also talked about taxes – the primary funding behind most social welfare programs. In the next chapter, we are going to examine Colonial America and see how the early Americans felt about taxation. Does knowing more about how we spend our money change your feelings about taxes? Despite the fact that America is very charitable and believe strongly in helping the most vulnerable, most of us hate paying taxes.

Finally, we have talked about primary American values. As we walk through social welfare history, we will continue to talk about these values and reflect on why we are the way we are. What do you think about going to be the overriding values in the Colonial era?

References

Borstelmann, T. (2020). Just like us: the American struggle to understand foreigners. Columbia University Press.

Center of Budget and Policy Priorities. (2020, Aug. 6). Policy Basics: Where Do Federal Tax Revenues Come From? https://www.cbpp.org/research/federal-tax/where-do-federal-tax-revenues-come-from.

Center on Budget and Policy Priorities. (2021, July 22). Families wait years for housing vouchers due to inadequate funding.

https://www.cbpp.org/sites/default/files/7-22-21hous.pdf.

Global POV. (n.d.) The #GlobalPOV Project: “Who is Dependent on Welfare” With Ananya Roy. [Video]. YouTube. https://www.youtube.com/watch?v=-rtySUhuokM.

National Association of Social Workers. (2022). NASW code of ethics. https://www.socialworkers.org/About/Ethics/Code-of-Ethics/Code-of-Ethics-English.

National Philanthropic Trust. (2022). Charitable Giving Statistics. https://www.nptrust.org/philanthropic-resources/charitable-giving-statistics/.

National Priorities Project. (2020). Federal spending: where does the money go? https://www.nationalpriorities.org/budget-basics/federal-budget-101/spending/.

Pew Research Center. (2019, May 14). Changing attitudes on same sex marriage. [Fact sheet]. https://www.pewresearch.org/religion/fact-sheet/changing-attitudes-on-gay-marriage/.

Tax Policy Center. (2022). Tax Policy Center briefing book: key elements of the U.S. tax system. Urban Institute & Brookings Institute. https://www.taxpolicycenter.org/briefing-book/what-are-major-federal-payroll-taxes-and-how-much-money-do-they-raise.

U.S. Small Business Administration. (2021, Nov. 4). the U.S. Small Business Administration is delivering support to America’s small businesses, helping them recover from the COVID-19 Pandemic. https://www.sba.gov/article/2021/nov/24/fact-sheet-us-small-business-administration-delivering-support-americas-small-businesses-helping.