2 The Basics

Stephanie Saulnier

Social welfare is the well-being of a society. The general response by a society to the well-being of its citizens, generally considered to be social welfare policy, can be in the form of supports, services, programs, legislative actions or judicial action. It can be at the local, state or federal level and can be administered by the government or through various agencies, organizations and individuals.

Social welfare policy affects every member of a society in all aspects of our lives. We tend to consider social welfare to consist of support for people in poverty such as cash assistance and food stamps but it is actually much broader. You are a student at a university. If you are like millions of other college students, you are the recipient of some type of financial assistance – either through a Pell grant or local, state or federal financial aid. You filled out a Free Application for Federal Student Aid (FAFSA) to determine your eligibility for that financial assistance. If you are at a public higher education institution, your rights as a student are protected by the Federal Educational Rights and Protection Act. You may be protected by Title IX of the Education Amendments of 1972. While you were in high school, you or your family may have qualified for the Supplemental Nutrition Assistance Program or the Federal School Lunch Program. You were provided a free, appropriate, public education, regardless of disability status or income level. If your parents or guardians owned the home you lived in, they benefited from a tax deduction. They were also able to use a tax credit for each child in your household. All of these programs and policies are social welfare. While some of these programs and policies are selective, tied to income level and status such as SNAP, others are universal, meaning that all qualify regardless of income such as FERPA.

Corporations and businesses also benefit from social welfare policy. During the Covid 19 pandemic, more than 6 million small businesses received $416.3 billion just in 2021 (US Small Business Administration, 2021). In addition to financial assistance, corporations and businesses are required to follow legislative requirements and regulations, such as mask mandates or closure orders.

This video provides a look at who is a recipient of social welfare:

The #GlobalPOV Project: “Who is Dependent on Welfare” With Ananya Roy

Section 2.1 Taxes, social welfare policy and the budget

As we learned in elementary school, one of the foremost reasons we became our own country was because of taxation. One cause of the Revolutionary War was taxation without representation and our intense distaste for taxes has not abated. Because taxes fund social welfare at all levels, it is important that we have a basic understanding of taxation in the US.

At the local, state and federal level, government budgets are primarily funded through taxes. For this chapter, we are going to focus mostly on the federal taxes.

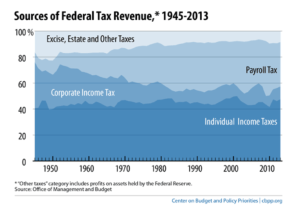

Figure 2.1: Sources of Federal Tax Revenue, 1945-2013

About 50 percent of revenue is individual contributions based on the individual or married couple’s income. The individual income tax is considered a progressive tax. In theory, a progressive tax is one in which a person making more money pays a higher percentage of their income in taxes, usually called a tax bracket. Progressive taxes are one way of addressing inequality. People who make more money should contribute more and people making less money should be able to keep more of their money. The reality in the US however is that income taxes are a lot more complicated. While the actual dollar amount that high income earners pay is higher, they often have access to more tax credits and deductions than lower income earners do.

Tax credits and deductions are tools the government uses to reward or provide financial incentive or support for certain behaviors. These are often things we typically consider to be in line with our societal values and cultural norms but can be tied to activities outside the experience of those with lower incomes.

Some examples of tax credits include:

-

- Child tax credit for children under the age 18

- Child and dependent care tax credit for money spending child or dependent care

- American opportunity tax credit for money spent on tuition, books or school fees.

- Lifetime learning credit also for tuition and fees.

- Student loan interest deduction for repayment of college loans.

- Adoption credit for fees related to adopting children.

- Earned income tax credit for low-income workers.

- Residential energy credits for installation costs of solar energy.

Some examples of tax deductions include:

-

- Charitable donations.

- Medical expenses.

- Mortgage interest.

- Individual Retirement Accounts contributions.

- Health Savings Account contributions.

High income earners often make their income in forms outside a typical paycheck. As an illustration, let’s look at the compensation of a head football coach at a large state university in the south. His base salary is $245,000 so he will pay income taxes on that amount at the normal rate for his tax bracket minus any credits or deductions he has. But this coach makes $6.25 million more a year in supplemental compensation. That compensation might be in the form of cash bonuses for television ads, a certain number of wins, championships and bowl games appearances, or vehicles, travel and housing. This income will also be taxed but under different rules regarding how much and when. This is often the case for high-level corporate executives who can take their compensation in stock options or deferred compensation and use a different, often lower tax rate.

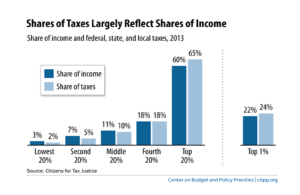

And for the top 1%, those multi-million and billionaires, the formula is completely different, often allowing them to pay little to no income taxes. This is illustrated in the chart below.

Figure 2.2: Shares of Taxes based on share of income

All American employees are also subject to payroll taxes which are earmarked for specific funds such as Social Security and Medicare at the federal level, and education or 911 services at the local levels. Payroll taxes are regressive, meaning that everyone pays the same percentage regardless of income.

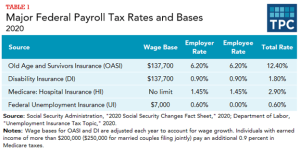

Figure 2.3: Major Federal Payroll Tax Rates and Bases 2023

Payroll taxes are paid by both employers and employees – each pays half of the total rate. This was a result of the Social Security Act of 1935. Old Age and Survivors Insurance (OASI) is commonly called Social Security retirement benefits. Disability Insurance (DI), commonly called SSDI, provides income for people who acquire disabilities after having worked a certain number of months during their lifetime. Medicare is health coverage for people over the age of 65 and some people with disabilities.

It is important to note that there is a “wage base” or limit on the income which is subject to OASI and DI as noted above. All wage earners between $0 and the wage base pay 6.2% in OASI and .9% in DI. Once the employee reaches a year-to-date compensation of the wage base, however, they no longer have to pay any OASI or DI on that amount. The wage base can increase or decrease each year based on the national wage index base. In 2023 as noted above, it was $160,200. In 2022, it was $147,000. The reason that this is considered a regressive tax is that 6.2% of the income of someone making $25,000 is going to have a much bigger impact than 6.2% of the first half of the income of someone making $275,000 a year. Also, payroll taxes are only applied to the base salary. So, as noted above, someone who receives the majority of their income through bonuses or stock options will not pay as much payroll tax.

The remaining tax money used by the government to fund social welfare comes from businesses and corporations and taxes paid on specific things such as property, estates and certain goods (excise taxes). As you can see from the chart at the beginning of this section, those taxes account for only about 15% of the federal budget.

Section 2.2 Budgets and social welfare policy

Social welfare policy is the collective response of a society, usually through the government, to the needs of the people. This is largely done through policy at the legislative and executive levels, implemented through programs and services provided at the local and state levels. Often the judicial branch is called to determine the constitutionality of those policies and how taxes are collected and spent.

The federal budget process is long and complex. It starts with the president submitting their budget request that outlines their administrative priorities. Congress then develops its own budget resolution, following by the enacting of budget legislation. It is not often that the president and Congress have the same priorities which means that the budget process is long and contentious. There is more about the whole process from The Center on Budget and Policy Priorities.

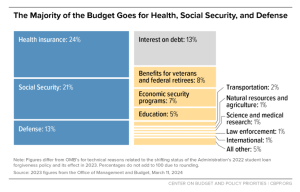

There are three basic types of spending in the federal budget: mandatory and discretionary and interest on the national debt. Mandatory spending covers the programs that are set by law and instead of having a set amount of money, they have rules for who can receive the money. Anyone that meets the criteria receives the service or money. The three biggest programs of this category are Social Security (that Old Age and Survivors Insurance covered earlier), Medicare (Disability Insurance) and Medicaid, medical coverage for children and people with low income. This category also includes Supplemental Nutrition Assistance Program (“food stamps”), federal civilian and military retirement benefits, veterans’ disability benefits and unemployment insurance. As you can see in the chart below, there are also other programs that are automatically included in the budget at set spending levels. Highway construction and maintenance as well as agricultural programs such as the Beginning Farmers and Ranchers Development program are under mandatory spending.

Because mandatory money does not technically run out, it allows more flexibility in responding to unexpected circumstances such as the Covid 19 pandemic. The federal response to the pandemic was largely funded through mandatory spending programs. This meant that anyone that qualified for a program was able to participate without regard to total cost. Through the CARES legislation, states were able to provide unemployment benefits to people not usually covered by unemployment insurance. The federal government also was able to provide stimulus checks to taxpayers and advances on the Child Tax Credit to parents through mandatory spending categories.

Discretionary spending, however, is set by Congress at a specific funding level. This area of spending is more likely to represent the values of the majority party in Congress, as they are able to control the budget process. As you can see in the chart below, national defense spending is almost half of all discretionary spending. Unlike mandatory spending, money given in these categories can and does run out, often leaving needs unmet.

An example of this is in the housing and community sector. Federal support for housing subsidies for low income families is part of the discretionary spending budget. The federal government provides grants and financial assistance to states and local governments to provide financial assistance for individuals and families who have incomes below the federal poverty rate. This assistance is often in the form of Section 8 housing vouchers, payments to landlords to supplement the rent paid by the resident. Because the funding for all housing and community programs is restricted through the budget process, states and localities often run out of money before serving all eligible residents. The national average wait time for Section 8 housing vouchers is two and a half years (CBPP, 2021).

As social workers, we are keenly aware of discretionary spending at the federal and state levels as this often provides the financial support for services most needed by our populations at risk.

Figure 2.4: Budget outlays for 2023

References

Center of Budget and Policy Priorities. (2025, Jan. 28). Policy Basics: Where Do Federal Tax Revenues Come From? https://www.cbpp.org/research/federal-tax/where-do-federal-tax-revenues-come-from.

Center for Budget and Policy Priorities. (2014, May 5). Chart Book: Top Eleven Tax Charts. https://www.cbpp.org/research/chart-book-top-eleven-tax-charts.

Center on Budget and Policy Priorities. (2021, July 22). Families wait years for housing vouchers due to inadequate funding.

https://www.cbpp.org/sites/default/files/7-22-21hous.pdf.

Global POV. (n.d.) The #GlobalPOV Project: “Who is Dependent on Welfare” With Ananya Roy. [Video]. YouTube. https://www.youtube.com/watch?v=-rtySUhuokM.

National Priorities Project. (2020). Federal spending: where does the money go? https://www.nationalpriorities.org/budget-basics/federal-budget-101/spending/.

Tax Policy Center. (2022). Tax Policy Center briefing book: key elements of the U.S. tax system. Urban Institute & Brookings Institute. https://www.taxpolicycenter.org/briefing-book/what-are-major-federal-payroll-taxes-and-how-much-money-do-they-raise.

Tax Policy Center. (2024). Tax Policy Center briefing book: What are the major federal payroll taxes, and how much money do they raise? Urban Institute & Brookings Institute. https://taxpolicycenter.org/briefing-book/what-are-major-federal-payroll-taxes-and-how-much-money-do-they-raise.